Investment spending is procyclical. In the short run, are changes in investment affected more by changes in the expected marginal product of capital, or by changes in the user cost of capital?

What will be an ideal response?

More by changes in the expected marginal product of capital. Investment spending is positively related to the expected marginal product of capital. In the short run, the expected MPK depends mostly on the expected level of output. The level of investment will conform to gloomy or optimistic forecasts, thus reinforcing them. The user cost of capital is positively related to both the real interest rate and the real price of capital, which are procyclical. Changes in the user cost of capital impact investment in the opposite (countercyclical) direction, but this effect is overwhelmed by the changes in the expected marginal product of capital.

You might also like to view...

Which of the following is ALWAYS true when a single-price monopolist maximizes its profit?

A) P = MC B) P = MR C) MR = MC D) MC = ATC E) P > ATC

A decrease in the rental rate of capital can lead to a long run increase or decrease in the number of firms in the industry.

Answer the following statement true (T) or false (F)

When the economy is getting the most from its scarce resources it is called: a. equity

b. efficiency. c. equality. d. equal shares.

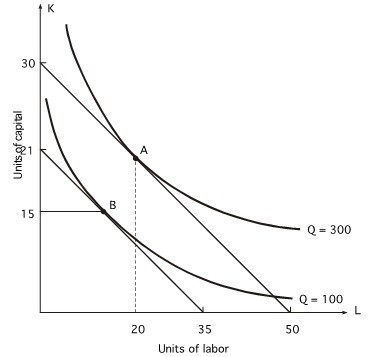

Refer to the following graph. The price of labor is $3 per unit: What is the minimum cost of producing 100 units of output?

What is the minimum cost of producing 100 units of output?

A. $150 B. $105 C. $60 D. $75