If the income tax system were indexed, a person whose nominal income went up from $30,000 to $33,000 in a year when the price index rose by 10 percent would pay

a. no increases in nominal income taxes.

b. no increases in real income taxes.

c. lower taxes in both real and nominal terms.

d. higher taxes in both real and nominal terms.

b

You might also like to view...

When measured as a percentage of GDP, the U.S. national debt reached its highest levels as a result of:

a. World War II. b. The Vietnam War. c. The Reagan defense buildup and tax cut. d. The Bush economic recovery program.

If prices (as measured by the CPI) fell by one-half and nominal wages fell by one-third, what would happen to real wages?

a. They would fall by one-third b. They would remain unchanged c. They would decrease d. They would increase e. They would fall by one-half

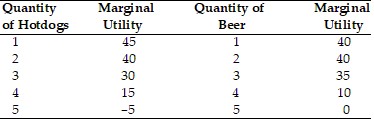

Jerry's Marginal Utility for consuming beer and pizza with $8.00 in income In the above table, how many hotdogs and beers will Jerry consume if the price of one hotdog is $2.00 and the price of a beer is $2.00?

In the above table, how many hotdogs and beers will Jerry consume if the price of one hotdog is $2.00 and the price of a beer is $2.00?

A. 1 hotdog and 3 beers B. 2 hotdogs and 3 beers C. 3 hotdogs and 1 beer D. 2 hotdogs and 2 beers

The Speedy Typesetting Company, a perfectly competitive firm, is currently producing where P = MC and is earning a normal profit. The yearly licensing fee that this firm must pay for the use of a statistical software program was just increased from $1,000 to $1,200. In the short run, this firm will most likely

A. reduce the amount of output it produces because its cost curves have shifted up and to the left. B. produce more units of output to increase revenue to cover the additional fixed costs. C. continue to produce the same amount of output because only its fixed costs have increased. D. shut down because it will no longer be earning a normal profit.