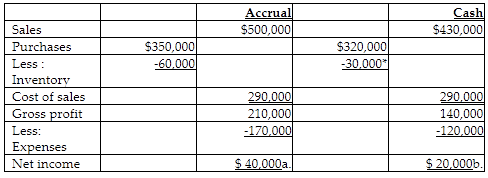

Chance Corporation began operating a new retail business in the current year and had $500,000 of sales, $70,000 of which had not been collected by year-end. Total purchases were $350,000 on which $30,000 is still owed. Ending inventory is $60,000; operating expenses are $170,000, $50,000 of which is still owed at year-end.

a. Compute net income from the business under the accrual method.

b. Compute net income from the business under the cash method.

c. Would paying the $50,000 she owes for operating expenses before year-end change her net income under the accrual method? Under the cash method?

* $60,000 - $30,000 (amount still owed) = $30,000.

c. Paying the $50,000 will not change the net amount of business income under the accrual method. Under cash method, payment of the $50,000 expense would result in a $30,000 net loss.

You might also like to view...

________ are characteristics that distinguish certain members of a society from others, based on a variety of factors such as wealth, education, and ancestry

A) Social classes B) Cultures C) Reference groups D) Attitudes E) Lifestyles

Residual income is an example of a ____ performance measurement

a. long-term b. short-term c. qualitative d. profit center

Financial professionals who are overconfident fall victim to which fallacy?

A. fallacy of unrealistic optimism B. fallacy of omnipotence C. fallacy of invulnerability D. none of these

An analysis of a group of studies supported the fact that having supportive supervisors and a supportive organization reduces work-family conflict among employees

Indicate whether the statement is true or false.