A tax that imposes a small excess burden relative to the tax revenue that it raises is

A) an efficient tax. B) a payroll tax. C) a sin tax. D) a FICA tax.

A

You might also like to view...

Describe the basic motives for businesses to merge

What will be an ideal response?

Shaina and Mariah have a business that provides personal fitness training services. They know that after raising their prices from $100 to $150 per hour, the quantity of hours they spent delivering training services fell from 45 to 40 hours per week. The demand for their services is:

a. elastic, with a price elasticity coefficient greater than one. b. elastic, with a price elasticity coefficient less than one. c. inelastic, with a price elasticity coefficient greater than one. d. inelastic, with a price elasticity coefficient less than one.

During which decade were John Maynard Keynes' ideas challenged?

a. 1930s b. 1940s c. 1960s d. 1970s e. 1980s

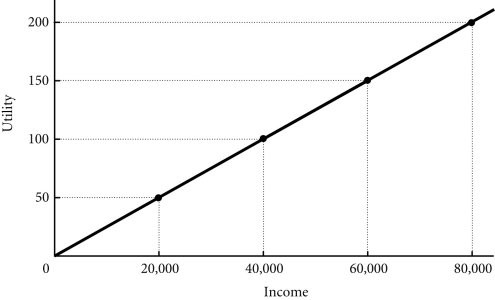

Refer to the information provided in Figure 17.2 below to answer the question(s) that follow.  Figure 17.2 Refer to Figure 17.2. Suppose Sam's utility from income is given in the diagram. From this we would say that Sam is

Figure 17.2 Refer to Figure 17.2. Suppose Sam's utility from income is given in the diagram. From this we would say that Sam is

A. a risk taker. B. risk-loving. C. risk-neutral. D. risk-averse.