What is normative myopia?

What will be an ideal response?

In business contexts, it can be easy to become so involved in the financial aspects of decisions that one loses sight of the ethical aspects. Some writers have called this inability to recognize ethical issues normative myopia, or shortsightedness about values.

You might also like to view...

According to research, engaging in two-way communication and striking a balance between open and closed questions are effective methods for improving sales success

Indicate whether the statement is true or false

The Commissioner of Health in the state of New York wanted to study malpractice litigation in Albany last year. She randomly selected 53,000 medical records from the population of 2.5 million patients in Albany last year. The proportion of malpractice claims filed from the 53,000 patients is an example of a(n) ____________________

Fill in the blank(s) with correct word

It is believed that the sales volume of one-liter Pepsi bottles depends on the price of the bottle and the price of a one-liter bottle of Coca-Cola. The following data have been collected for a certain sales region.Pepsi SalesPepsi PriceCola Price Pepsi SalesPepsi PriceCola Price11,4530.791.59 6,0031.341.1410,9820.841.69 5,5971.391.1911,1300.841.59 5,4051.441.149,9800.891.64 4,9601.491.149,8500.891.49 4,6101.541.099,8100.941.79 4,2341.590.999,6500.991.54 4,0831.641.098,0101.041.39 3,8891.690.947,8641.091.64 3,6051.791.047,7911.141.59 3,7101.840.997,3321.141.24 3,5331.840.997,5081.191.29 3,3951.890.946,6341.191.29 3,2291.940.89The linear model Pepsi Sales = ?0 + ?1Pepsi Price + ?2Cola Price + ? and the log-log model ln(Pepsi Sales) = ?0 + ?1ln(Pepsi Price)

+ ?2ln(Cola Price) + ? have been estimated as follows:VariableLinear ModelLog-Log ModelIntercept10,982.52238.9703Pepsi Price?5,528.7557N/ACola Price2,364.5870N/Aln(Pepsi Price)N/A?1.2709ln(Cola Price)N/A0.2692 R20.95680.9904Adjusted R20.95310.9895Standard Error se594.22990.0434What is the estimated linear regression model? What will be an ideal response?

Calculate the internal rate of return to determine whether it should accept this project.

Tressor Company is considering a 5-year project. The company plans to invest $90,000

now and it forecasts cash flows for each year of $27,000. The company requires that

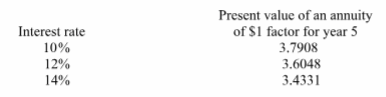

investments yield a discount rate of at least 14%. Selected factors for a present value of an

annuity of $1 for five years are shown below:

A) The project should be accepted because it will earn more than 14%.

B) The project should be accepted because it will earn more than 10%.

C) The project will earn more than 12% but less than 14%. At a hurdle rate of 14%, the project should be rejected.

D) The project should be rejected because it will earn less than 14%.

E) The project should be rejected because it will not earn exactly 14%.