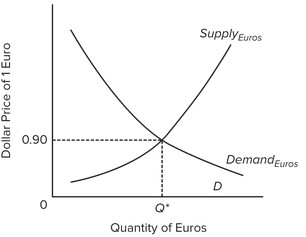

Use the following graph, which shows the market for euros, to answer the next question. Assume the United States and European governments adopt a system of flexible exchange rates. If currency traders think the European economy will experience a recession and the U.S. economy will not, this will most likely cause ________.

Assume the United States and European governments adopt a system of flexible exchange rates. If currency traders think the European economy will experience a recession and the U.S. economy will not, this will most likely cause ________.

A. the euro to depreciate

B. the U.S. dollar to depreciate

C. the supply of euros to decrease

D. the euro to appreciate

Answer: A

You might also like to view...

If the Japanese yen was 123 per dollar and now it is 114 yen per dollar, it can be said that

A) the yen has appreciated against the dollar. B) the yen has depreciated against the dollar. C) the dollar has appreciated against the yen. D) Both answers C and B are correct

Institutions that channel funds from people who have them to people who want them are called:

A. governmental agency. B. financial intermediaries. C. corporations. D. the Federal Reserve.

If the GDP gap is negative, then:

A. the inflation rate is rising. B. actual GDP is less than potential GDP. C. potential GDP is less than actual GDP. D. the unemployment rate is falling.

Majority-rule voting leads to logrolling.

Answer the following statement true (T) or false (F)