Which of the following statements is CORRECT?

A. If a security analyst saw that a firm's days' sales outstanding (DSO) was higher than the industry average and trending still higher, this would be interpreted as a sign of strength.

B. A high average DSO indicates that none of the firm's customers are paying on time. In addition, it makes no sense to evaluate the firm's DSO with the firm's credit terms.

C. There is no relationship between the days' sales outstanding (DSO) and the average collection period (ACP). These ratios measure entirely different things.

D. A reduction in accounts receivable would have no effect on the current ratio, but it would lead to an increase in the quick ratio.

E. If a firm increases its sales while holding its accounts receivable constant, then its days' sales outstanding will decline, other things held constant.

Answer: E

You might also like to view...

Merchandise Inventory increased $28,000 and Accounts Payable decreased $19,600 during the year. Accounts Payable relates only to the acquisition of merchandise inventory. Sales were $796,000 and Cost of Goods Sold was $549,700. Compute the payment made to the suppliers for inventory.

A) $577,700 B) $569,300 C) $597,300 D) $47,600

A journal entry includes a debit to Work in Process Inventory and a credit to Raw Material Inventory. The explanation for this would be that

a. indirect material was placed into production. b. raw material was purchased on account. c. direct material was placed into production. d. direct labor was used for production.

A list of accounts used by the business to record transactions is called a chart of accounts

Indicate whether the statement is true or false

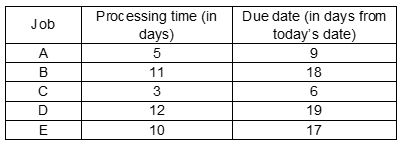

The average tardiness for jobs listed in the following table under the earliest due date (EDD) rule is ______.

A. 7.8 days

B. 6.8 days

C. 5.8 days

D. 4.8 days