Financial markets are important for bringing equilibrium to the loanable funds market, but do not affect the efficient allocation of scarce resources in the long-run

a. True

b. False

Indicate whether the statement is true or false

False

You might also like to view...

Which of the following statements is true?

A) The basis for both first-degree price discrimination and third-degree price discrimination is differences in the buyers' willingness to pay for a good. B) The basis for both first-degree price discrimination and third-degree price discrimination is differences in the sellers' willingness to accept payment for a good. C) The basis for first-degree price discrimination is differences in willingness to pay, whereas the basis for third-degree price discrimination is differences in the sellers' willingness to accept payment for a good. D) The basis for first-degree price discrimination is differences in the seller's willingness to accept payment for a good, whereas the basis for third-degree price discrimination is differences in buyers' willingness to pay for a good.

Suppose a farmer in a perfectly competitive agricultural industry rents land that is uniquely productive in the production of a certain crop. In the long run

A) the owner of the land receives economic rent while the farmer earns zero economic profit. B) the owner of the land earns zero economic profit while the farmer receives economic rent. C) both the farmer and the owner of the land receive economic rent. D) neither the farmer nor the owner of the land receive economic rent.

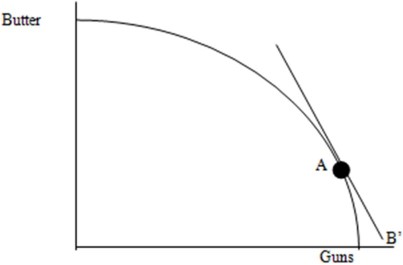

The diagram below shows the production possibilities frontier (PPF) for a country that produces guns (G) and butter (B). Most people in the country prefer guns, so in the absence of international trade, point A represents the combination of G and B that maximizes welfare. The slope of the PPF at point A is equal to -2.  What is the opportunity cost of 1 unit of guns before trade? What is the opportunity cost of 1 unit of butter?

What is the opportunity cost of 1 unit of guns before trade? What is the opportunity cost of 1 unit of butter?

What will be an ideal response?

Which one of the following is a tool of monetary policy for altering the reserves of commercial banks?

a. Budget surplus or budget deficit b. Federal Reserve Notes c. Treasury deposits d. Reserve ratio