Production costs per leaf blower total $20, which consists of $16 in variable production costs and $4 in fixed production costs (based on the 10,000 units produced). Fifteen percent of total selling and administrative expenses are variable. Compute net income under variable costing.

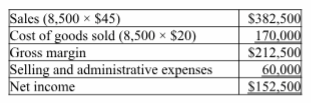

Wind Fall, a manufacturer of leaf blowers, began operations this year. During this year, the

company produced 10,000 leaf blowers and sold 8,500. At year-end, the company reported the following income statement using absorption costing:

A) $146,500

B) $158,500

C) $237,500

D) $206,500

E) $246,500

A) $146,500

Explanation: Income under absorption costing = Income under variable costing + FOH in

Ending inventory – FOH in Beginning inventory

$152,500 = Income under variable costing + (1,500 units × FOH $4) – (0 units × FOH $4)

$152,500 = Income under variable costing + $6,000 – $0

$146,500 = Income under variable costing

You might also like to view...

An exchange of one share of an old issue of stock for a multiple number of shares of a new issue of stock with a reduced par or stated value is known as a stock split

a. True b. False Indicate whether the statement is true or false

Alieia Boat Company manufactures 10 luxury yachts per month. A navigation system is included in each yacht. Alieia Boat manufactures the navigation system in-house but is considering the possibility of outsourcing this function. At present, the variable cost per unit is $300, and the fixed costs are $38,000 per month. If it outsources the security system, fixed costs could be reduced by half, and the vacant facilities could be rented out to earn $3000 per month of rental income. What is the maximum contract cost that Alieia should pay for outsourcing?

A) any cost lower than $2500 per unit B) any cost lower than $2200 per unit C) any cost lower than $300 per unit D) any cost lower than $3800 per unit

A common–size financial statement is a statement:

a. in which all accounts have been standardized by the overall size of the company. b. which is prepared while performing horizontal analysis of a company. c. which is prepared while performing ratio analysis of a company. d. in which all accounts are reported along with the changes from their prior–year balance.

A bond that matures in 5 years has less interest rate risk than a bond that matures in 25 years

because regardless of changes in interest rates, the bond can be redeemed for face value 20 years earlier. Indicate whether the statement is true or false