The imposition of a tariff will typically ________ government revenue and ________ domestic production of the good

A) increase; increase

B) increase; decrease

C) decrease; increase

D) decrease; decrease

E) increase; not change

A

You might also like to view...

According to your textbook, which of the following best explains the fact that income inequality has increased in the U.S. since 1980?

A) The weakening of the labor union movement B) A reduction in economic growth C) A growing distrust of the efficacy of federal government spending programs combined with a rising concern over federal budget deficits D) A rise in the number of single-parent families at low income levels and a rise in two-parent two-earner families at higher income levels

Supply-siders argue that:

a. reductions in government spending cut infrastructure investment which hurts private sector investment. b. increases in government spending increase infrastructure investment which helps private sector investment. c. increases in government spending causes private sector investment to fall because the government pushes up interest rates. d. reductions in government spending cause private sector investment to fall because the government pushes up interest rates by borrowing. e. increases in government spending causes consumption spending to fall because the government purchases push up interest rates.

Business cycle peaks are always followed by the _____ phase.

Fill in the blank(s) with the appropriate word(s).

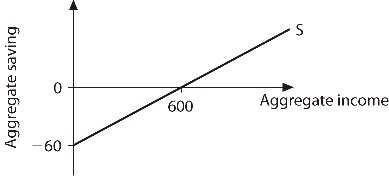

Refer to the information provided in Figure 23.6 below to answer the question(s) that follow. Figure 23.6Refer to Figure 23.6. If aggregate income is $800, aggregate saving is

Figure 23.6Refer to Figure 23.6. If aggregate income is $800, aggregate saving is

A. -$100. B. -$20. C. $20. D. $40.