Suppose a new pollution tax of $0.01 per kilowatt-hour of electricity is imposed on coal-fired power producers by the federal government. Which of the following correctly describes how this tax will affect the market for electricity served by these power plants?

a. Demand for electricity will increase.

b. Demand for electricity will decrease.

c. The supply of electricity will decrease.

d. The supply of electricity will increase.

c

You might also like to view...

Which of the following is not an excise tax?

a. A tax on cigarettes. b. A tax on beer. c. A tax on corporations. d. A tax on airline tickets.

When the average product is decreasing, marginal product

A) equals average product. B) is increasing. C) exceeds average product. D) is decreasing. E) is less than average product.

The savings rate in Josiane’s country has been very low for many years. Describe how this has likely impacted the country’s growth rate. Provide brief examples.

What will be an ideal response?

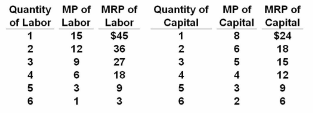

Refer to the given data. This firm is selling its product in:

A. an imperfectly competitive market at prices that decline as sales increase.

B. a purely competitive market at $3 per unit.

C. a purely competitive market at $2 per unit.

D. an imperfectly competitive market at $3 per unit.