A tax on a good has a deadweight loss if

a. the reduction in consumer and producer surplus is greater than the tax revenue.

b. the tax revenue is greater than the reduction in consumer and producer surplus.

c. the reduction in consumer surplus is greater than the reduction in producer surplus.

d. the reduction in producer surplus is greater than the reduction in consumer surplus.

Answer: a. the reduction in consumer and producer surplus is greater than the tax revenue.

You might also like to view...

The confidence interval for the sample regression function slope

A) can be used to conduct a test about a hypothesized population regression function slope. B) can be used to compare the value of the slope relative to that of the intercept. C) adds and subtracts 1.96 from the slope. D) allows you to make statements about the economic importance of your estimate.

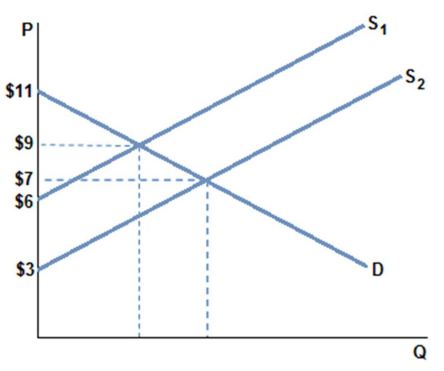

Assume the market is in equilibrium in the graph shown at demand D and supply S1. If the supply curve shifts to S2, and a new equilibrium is reached, which of the following is true?

A. Consumer surplus increases, and total surplus increases.

B. Consumer surplus decreases, and total surplus increases.

C. Consumer surplus increases, and total surplus decreases.

D. Consumer surplus decreases, and total surplus decreases.

Which of the following would cause the U.S. demand curve for Japanese yen to shift to the right?

a. An increase in the U.S. inflation rate compared to the rate in Japan. b. A higher real rate of interest on investments in Japan than on investments in the United States. c. The popularity of Japanese products increases in the United States. d. All of these.

If a widow is harmed by mail fraud,

a. she may be compensated under property law b. her legal action will be in the category of antitrust law c. she may be compensated under tort law d. this is a potential Pareto improvement e. an economic inefficiency has arisen