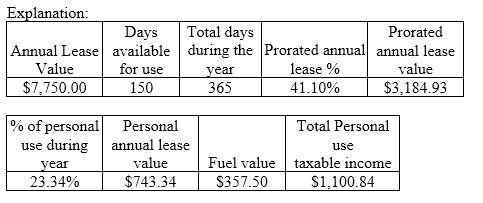

Frances McNale is an employee who drives a 2017 Ford C-Max with a fair-market value of $29,500. The lease value is $7,750, according to Publication 15-b. The car was available for 150 days during the year, and she reported that 6,500 of the 27,850 miles were driven for personal purposes. The company pays for all fuel and is charged back to Frances at $0.055 per mile. What is the amount of the

company-car fringe benefit that will appear on Frances's W-2, using the lease-value rule? (Do not round intermediate calculations, only round final answer to two decimal points.)

A) $1,100.84

B) $1,020.44

C) $743.34

D) $964.24

A) $1,100.84

You might also like to view...

People with ______ exhibit less anxiety, greater motivation, and stronger expectations that effort leads to performance.

A. high self-efficacy B. high self-monitoring C. low self-efficacy D. an internal locus of control E. an external locus of control

The portion of cost of goods available for sale that is not assigned to ending inventory is assigned to work in process

Indicate whether the statement is true or false

Your textbook identifies four characteristics of mass communication – one is that it primarily involves one way communication. Which of the following is NOT one of the other three?

a. It usually involves communication to a large, anonymous and heterogeneous audience b. It is usually transmitted through channels that work fast c. Senders are usually big organizations rather than individuals d. It is easily personalized to ensure all the audience perceive the message as important

An employer can find the incidence rate of injury and illness at the firm by dividing the number of injuries and illnesses by 200,000 and multiplying it with the total hours worked by all employees during the period covered.

Answer the following statement true (T) or false (F)