Suppose the auto industry has several investment projects with an expected rate of return of 15 percent, the aluminum industry has projects with an expected return of over 20 percent, the publishing industry projects with an expected return of 10

percent, the steel industry has projects with an expected return of 7 percent and the rubber industry projects with an expected return of 5 percent. The current market rate of interest is 7 percent. A reduction in the supply of funds causes interest rates to rise to 11 percent. The effect is to

A) cause the firms in the steel and publishing industries to cancel their projects, which would have been funded at the old interest rate.

B) cause the firms in the steel and the rubber industries to go ahead with their projects.

C) force the firms in the automobile industry and the publishing industry to rely on funding their projects through other means.

D) make the projects of the aluminum industry and the steel industry unprofitable; the firms in these industries will not borrow the funds or make the investments.

Answer: A

You might also like to view...

Assume that business investment spending rises, and the increase is funded by greater borrowing in the capital markets. If the nation has low mobility international capital markets and a fixed exchange rate system, what happens to the nominal exchange rate and monetary base in the context of the Three-Sector-Model? a. The nominal exchange rate rises and monetary base rises

b. The nominal exchange rate remains the same and monetary base falls. c. The nominal exchange rate remains the same and monetary base rises. d. The nominal exchange rate and monetary base remain the same. e. There is not enough information to determine what happens to these two macroeconomic variables.

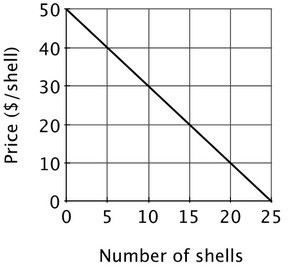

There are 20 residents in the village of Towneburg. The size of the village's annual fireworks display depends upon the number of shells that are fired off. Each resident's demand for fireworks is shown below. The total cost of the fireworks display is $1,000 plus $10 per shell. Collectively, the residents of Towneburg would be willing to pay ________ for the 25th shell, and the marginal cost of the 25th shell is ________.

Collectively, the residents of Towneburg would be willing to pay ________ for the 25th shell, and the marginal cost of the 25th shell is ________.

A. $20; $10 B. $0; $10 C. $0; $3,500 D. $10; $2,500

An example of an import of a service in the U.S. balance of payments would be when

A) an U.S. resident purchases a Japanese stereo. B) a Norwegian traveling in the United States rides a trolley car in San Francisco. C) a U.S. resident buying insurance from a firm in Toronto. D) a U.S. firm purchases 100 shares of a Dutch firm.

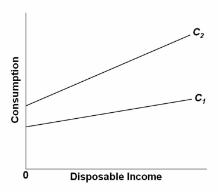

Refer to the given diagram. Suppose an economy's consumption schedule shifts from C 1 to C 2 as shown in the diagram. We can say that its:

A. MPC has increased, but its APC at each income level is unchanged.

B. APC at each income level is increased, but its MPC is unchanged.

C. MPC and APC at each income level have both increased.

D. MPC and APC at each income level have both decreased.