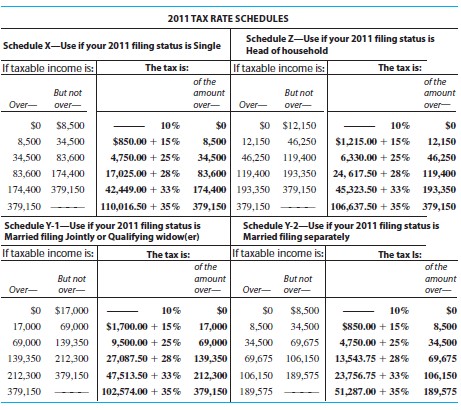

Find the tax. Use $3700 for each personal exemption; a standard deduction of $5800 for single people, $11,600 for married people filing jointly, $5800 for married people filing separately, and $8500 for head of a household; and the tax rate schedule.  The Greenwoods had an adjusted gross income of $57,963 last year. The had deductions of $1037 for state income tax, $4262 for property tax, $5171 in mortgage interest, and $1343 in contributions. The Greenwoods claim four exemptions and file a joint return.

The Greenwoods had an adjusted gross income of $57,963 last year. The had deductions of $1037 for state income tax, $4262 for property tax, $5171 in mortgage interest, and $1343 in contributions. The Greenwoods claim four exemptions and file a joint return.

A. $3884.45

B. $3852.50

C. $5517.50

D. $8099.45

Answer: B

Mathematics

You might also like to view...

Express the vector as a product of its length and direction. j - 2k

j - 2k

A.  (j - k)

(j - k)

B.

C.

D.

Mathematics

Use a calculator to approximate the logarithm to four decimal places.ln 0.993

A. -0.0070 B. 0.0070 C. 0.0031 D. -0.0031

Mathematics

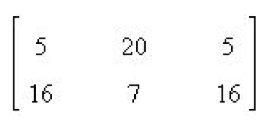

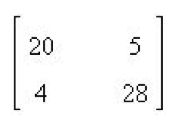

Find 4A.

a.

b.

c.

d.

e.

Mathematics

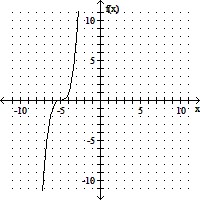

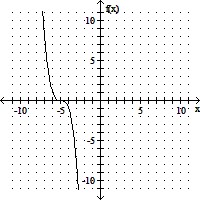

Graph the function.f(x) = -x3 + 5

A.

B.

C.

D.

Mathematics