The commercial banks in Fundland have

Reserves $500 million

Loans $3,500 million

Deposits $4,000 million

Total assets $5,000 million

The banks hold no excess reserves.

a) Calculate the banks' desired reserve ratio.

b) An immigrant arrives in Fundland with $10 million, which she deposits in a bank. How much does the immigrant's bank lend initially?

a) With no excess reserves, the desired reserve ratio is the fraction of banks' total deposits that are held in reserves. So in Fundland, the banks' desired reserve ratio is 500/4000 = 0.125 or

12.5 percent.

b) With a desired reserve ratio of 12.5 percent, the bank keeps $10 million × 0.125 = $1.25 million on reserve. It then lends the rest, so it lends $10 million - $1.25 million, which is

$8.75 million.

You might also like to view...

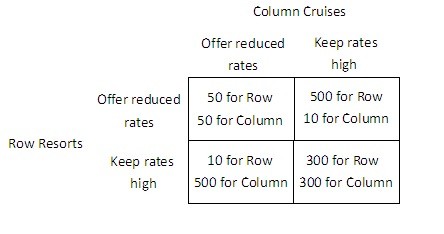

Refer to the figure below.  If Column Cruises offers reduced rates, and Row Resorts keeps its rates high, then Row Resorts will earn ________, and Column Cruises will earn ________.

If Column Cruises offers reduced rates, and Row Resorts keeps its rates high, then Row Resorts will earn ________, and Column Cruises will earn ________.

A. 300; 300 B. 10; 500 C. 500; 10 D. 50; 50

Use the following table to answer the next question. All figures in the table below are in billions of dollars.RGDPAggregate Expenditures (Closed Economy - No International Trade)ExportsImports$400$440$50$60450480506050052050605505605060600600506065064050607006805060If this economy were closed to international trade, then the equilibrium real GDP would be ________ billion and the multiplier would be ________.

A. $600;5 B. $600;4 C. $500;5 D. $500;4

The figure above shows the U.S. demand and U.S. supply curves for cherries. At a world price of $2 per pound once international trade occurs, the total exports of cherries from the United States to other nations equals

A) 200,000 pounds. B) 400,000 pounds. C) 600,000 pounds. D) 800,000 pounds. E) 0 pounds.

The classical model is a poor predictor of short-run economic fluctuations in part because it assumes that

a. all workers wish to work b. government will prevent these fluctuations c. the labor market always clears d. the long run is just a series of short-run periods e. labor demand curve is stable