Flannigan Company manufactures and sells a single product that sells for $450 per unit; variable costs are $270. Annual fixed costs are $800,000. Current sales volume is $4,200,000. Flannigan Company management targets an annual pre-tax income of $1,125,000. Compute the unit sales to earn the target pre-tax net income.

A) 4,444.

B) 7,500.

C) 6,650.

D) 10,694.

E) 11,750.

D) 10,694.

Explanation: $450 – $270 = $180; ($800,000+ $1,125,000)/$180 = 10,694 units

You might also like to view...

Your firm adheres strictly to the residual dividend model. All else equal, which of the following factors would be most likely to lead to an increase in the firm's dividend per share?

A. The firm's net income increases. B. The company increases the percentage of equity in its target capital structure. C. The number of profitable potential projects increases. D. Congress lowers the tax rate on capital gains, leaving the rest of the tax code unchanged. E. Earnings are unchanged, but the firm issues new shares of common stock.

The difference between the observed value of the dependent variable and the value predicted by using the estimated regression equation is called _____

a. the standard error b. a residual c. a prediction interval d. the variance

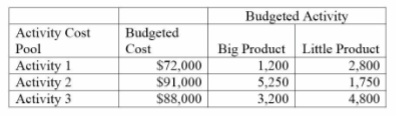

Annual production and sales level of big product is 62,525 units, and the annual production and sales level of little product is 251,900 units.

A company has two products: Big and Little. It uses activity-based costing and has prepared the following analysis showing budgeted cost and activity for each of its three activity cost pools:

a. Compute the approximate overhead cost per unit of big product under activity-based costing.

b. Compute the approximate overhead cost per unit of little product under activity-based costing.

Which of the following is the lowest level of employee involvement?

A. Consult with individuals B. Ask employees for specific information C. Describe the problem to employees and ask for information D. Create a team to make the decision E. Create a team to make recommendations