A financial services company offers to pay you $1,000 a year for life in exchange for $20,000 today. What factors affect your decision to take this offer?

What will be an ideal response?

This policy has an internal rate of return of 1/20 = 5%. If the interest rate exceeds 5%, then there are better investments elsewhere. If the interest rate is less than 5%, this is a good deal.

You might also like to view...

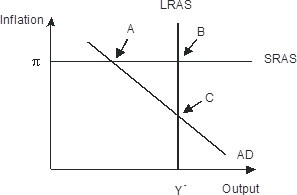

The economy pictured in the figure below has a(n) ________ gap with a short-run equilibrium combination of inflation and output indicated by point ________.

A. recessionary; B B. recessionary; C C. recessionary; A D. expansionary; A

If the market for a product begins as perfectly competitive and then becomes a monopoly, there will be a reduction in economic efficiency and a deadweight loss

Indicate whether the statement is true or false

The rate a bank pays for deposit insurance should be independent of the investments undertaken by the bank with depositors' funds

Indicate whether the statement is true or false

The subject of economics is primarily the study of:

a. the government decision-making process. b. how to operate a business successfully. c. decision-making because of the problem of scarcity. d. how to make money in the stock market.