The main idea behind supply-side tax cuts is that

A. tax cuts increase spending, which increases aggregate supply.

B. some tax cuts can increase aggregate supply.

C. people like lower taxes and will spend more if they get them.

D. it is easier to shift aggregate supply than aggregate demand.

Answer: B

You might also like to view...

If reckless drivers are more likely than safe drivers to buy automobile insurance, then a moral hazard problem has occurred

Indicate whether the statement is true or false

Which of the following nations DOES use the euro and participates in the Treaty on European Union?

A) Sweden B) Denmark C) Portugal D) The United Kingdom E) Norway

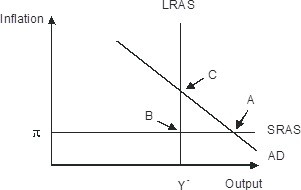

Refer to the figure below. In response to gradually falling inflation, this economy will eventually move from its short-run equilibrium to its long-run equilibrium. Graphically, this would be seen as

A. long-run aggregate supply shifting leftward B. Short-run aggregate supply shifting upward C. Short-run aggregate supply shifting downward D. Aggregate demand shifting leftward

To maximize profits, an airline will offer _____ prices to customers with _____ demand.

A. lower; inelastic B. higher; elastic C. the lowest; the least D. higher; inelastic