A bond will pay $10,000 to its owner in 5 years. If the relevant annual interest rate is 5%, what is the bond worth today (rounded to the nearest 100)?

A. $9,500

B. $7,800

C. $6,600

D. $1,900

E. None of the above.

Answer: B

You might also like to view...

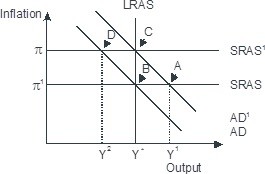

Based on the figure below. Starting from long-run equilibrium at point C, a tax increase that decreases aggregate demand from AD1 to AD will lead to a short-run equilibrium at point ________ and eventually to a long-run equilibrium at point ________, if left to self-correcting tendencies.

A. D; C B. D; B C. A; B D. B; C

When regulators chose to allow insolvent S&Ls to continue to operate rather than to close them, they were pursuing a policy of

A) regulatory forbearance. B) regulatory kindness. C) ostrich reasoning. D) ignorance reasoning.

Everything else held constant, if aggregate output is to the ________ of the LM curve, then there is an excess ________ of money which will cause the interest rate to rise

A) right; supply B) right; demand C) left; supply D) left; demand

The burden of the payroll tax falls entirely on the employee regardless of how it is formally divided between employer and employee if the

a. demand for labor is inelastic. b. supply of labor curve is horizontal. c. supply of labor curve is virtually vertical. d. demand for labor curve is elastic.