On January 1, Frederic Manufacturing had a beginning balance in Work-in-Process Inventory of $160,000 and a beginning balance in Finished Goods Inventory of $20,000. During the year, Frederic incurred manufacturing costs of $205,000.

During the year, the following transactions occurred:

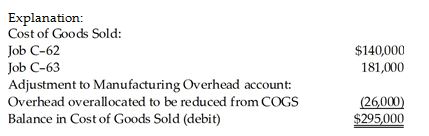

Job C-62 was completed for a total cost of $140,000 and was sold for $158,000.

Job C-63 was completed for a total cost of $181,000 and was sold for $213,000.

Job C-64 was completed for a total cost $84,000 but was not sold as of year-end.

The Manufacturing Overhead account had an unadjusted credit balance of $26,000 and was adjusted to zero at year-end.

What was the final balance in the Cost of Goods Sold account?

A) $295,000 debit balance

B) $347,000 debit balance

C) $347,000 credit balance

D) $295,000 credit balance

A) $295,000 debit balance

You might also like to view...

The success or failure of a group depends on how it is led and managed.

Answer the following statement true (T) or false (F)

Economic needs are concerned only with getting the best quality at the lowest price.

Answer the following statement true (T) or false (F)

Gina writes and signs a check payable to "Happy Market." Ira, Happy's manager, indorses the check "For deposit only." This is

A. a blank indorsement. B. a qualified indorsement. C. a restrictive indorsement. D. a special indorsement.

The doctrine of judicial immunity protects judges' ability to:

a. respond to public opinion b. be independent decision makers c. work from home d. be influenced by political parties e. none of the other choices are correct