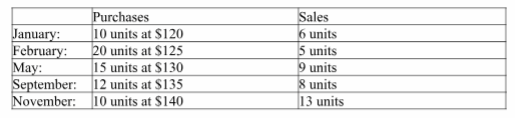

A company had the following purchases and sales during its first year of operations:

On December 31, there were 26 units remaining in ending inventory. Using the Periodic LIFO inventory valuation method, what is the cost of the ending inventory? (Assume all sales were made on the last day of the month.)

A) $3,405.

B) $3,270.

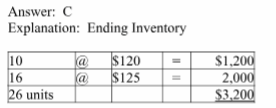

C) $3,200.

D) $3,364.

E) $5,400.

B) $3,270.

You might also like to view...

A modification of ________ allows the neutral adviser to settle the case if the corporate executives cannot agree on a means of resolving the dispute within a given period of time

A) a minitrial B) mediation C) negotiation D) early neutral case evaluation

In extending an expense item for the current budget year, an often-used and useful approach is to

A) use last year's figure. B) use the average of the last three years. C) use last year's figure plus a usual 10% "fudge factor." D) adjust last year's figure upwards by this year's expected inflation.

Wickland Company installs a manufacturing machine in its production facility at the beginning of the year at a cost of $93,000. The machine's useful life is estimated to be 20 years, or 390,000 units of product, with a $7000 salvage value. During its second year, the machine produces 15,600 units of product. Determine the machines' second year depreciation under the straight-line method.

A. $4300. B. $4650. C. $5000. D. $3440. E. $3720.

To realize improvements in ease of production, a company should

A. keep production methods constant for employee continuity. B. increase the average number of customer queries solved per day. C. create an additional product as an adjunct to the main product. D. design products with fewer component parts. E. decrease the number of employees performing a particular task.