Supply-side policy is based on the assumption that people's economic behavior is not affected by taxes

a. True

b. False

Indicate whether the statement is true or false

False

You might also like to view...

The above table has data from the nation of Media. Based on these data, when disposable income is $8.0 trillion, saving is

A) -$1.5 trillion. B) $1.5 trillion. C) $7.5 trillion. D) $0.5 trillion. E) -$0.5 trillion.

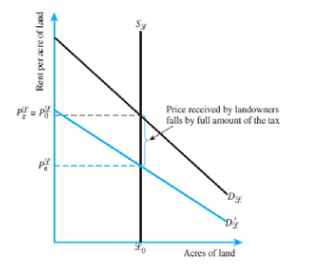

Refer to Figure 22.2 below. Suppose that the supply of land is constant at L acres, and Price per acre is $400. In addition, the before-tax demand for land can be characterized by the equation P = 500 - 2L, where L is the acres of land and P is the price.

(A) What is the constant supply of land (L) in the market?

(B) If the after-tax demand curve, P , can be written as P = 400 - 4L, what is P , and how

much tax revenue is generated?

If a student achieves a high SAT score, this

A) sends a signal to a college that the applicant will be a good college student. B) does not act as a screening device. C) is a moral hazard. D) provides a college with no information.

Suppose the domestic market demand function in a certain market where Q is measured in thousands of units is Qd = 20 - 2.5P, and the domestic market supply function is Qs = 2.5P - 7.5. Suppose further that the world price for the good in question is $3.40 per unit. If the government places a $1.20 tariff on imported units of this good, by how much is producer surplus increased?

A. $3,200 B. $3,600 C. $5,400 D. $3,000