A tax imposed on a good can:

A. prevent the market from reaching an efficient equilibrium.

B. encourage production of the good.

C. discourage consumption of the good.

D. increase the supply of complementary goods.

Answer: C

You might also like to view...

Starting from long-run equilibrium, an increase in autonomous investment results in ________ output in the short run and ________ output in the long run.

A. lower; potential B. higher; higher C. lower; higher D. higher; potential

What would be the likely result of a recessionary gap? If this leads to a fall in the nominal wage what impact it would have on the aggregate supply curve and on recessionary gap?

According to classical macroeconomic theory, changes in the money supply change real GDP but not the price level

a. True b. False Indicate whether the statement is true or false

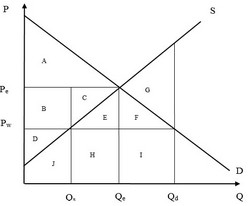

Use the following figure showing the domestic demand and supply curves for product B in a hypothetical economy to answer the next question. After trade, at a world price of Pw, consumer surplus equals area(s)

After trade, at a world price of Pw, consumer surplus equals area(s)

A. B + C + E + F. B. A. C. A + B + C + E + F. D. A + B + C + D.