Assume the indirect method is used to compute net cash flows from operating activities. For this item extracted from the financial statements-Decrease in Inventory-indicate the effect on net income in arriving at net cash flows from operating activities by choosing one of the following:

A) Add to net income to arrive at net cash flows from operating activities.

B) Subtract from net income to arrive at net cash flows from operating activities.

C) Not used to adjust net income to calculate net cash flows from operating activities.

A

You might also like to view...

Premium on bonds payable may be amortized by the straight-line method if the results obtained by its use do notmaterially differ from the results obtained by use of the interest method

a. True b. False Indicate whether the statement is true or false

Marks Corporation has two operating departments, Drilling and Grinding, and an office. The three categories of office expenses are allocated to the two departments using different allocation bases. The following information is available for the current period: Office ExpensesTotal Allocation BasisSalaries$30,000 Number of employeesDepreciation 20,000 Cost of goods soldAdvertising 40,000 Net sales ItemDrilling Grinding TotalNumber of employees 1,000 1,500 2,500 Net sales$325,000 $475,000 $800,000 Cost of goods sold$75,000 $125,000 $200,000 The amount of salaries that should be allocated to Drilling for the current period is:

A. $10,000. B. $12,000. C. $15,000. D. $18,000. E. $30,000.

Which of the following statements is true about cohort analysis?

A) A cohort is a group of respondents who experience the same event within the same time interval. B) It is unlikely that any of the individuals studied at time one will also be in the sample at time two. C) The term cohort analysis refers to any study in which there are measures of some characteristics of one or more cohorts at two or more points in time. D) All are correct.

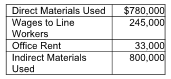

How much is the total product costs for the year?

Rios Corporation reports costs for the year as follows:

A) $800,000

B) $1,825,000

C) $1,858,000

D) $1,025,000