Economists tend to see taxing an action that produces a negative externality as:

A. the best solution possible, but often unattainable.

B. the second best solution possible but one that is attainable.

C. the best solution possible and often the most attainable.

D. the second best solution possible, but often unattainable.

B. the second best solution possible but one that is attainable.

You might also like to view...

A federal budget deficit

a. occurs when government expenditures exceed tax revenues. b. occurs when monetary policy works in the opposite direction of fiscal policy. c. occurs when tax revenues exceed government expenditures. d. occurs when transfer payments exceed tax revenues. e. will always result when Congress and the president cannot agree on expenditures.

Accounting profits are typically

A) greater than economic profits because accounting profits do not include explicit costs. B) greater than economic profits because accounting profits do not include implicit costs. C) smaller than economic profits because accounting profits do not include explicit costs. D) equal to economic profits in the long run.

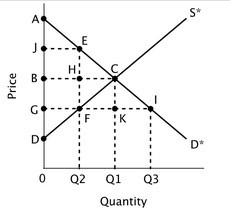

Refer to the figure below. If a price ceiling were imposed at point G, the loss in total economic surplus would be represented by the area ________.

If a price ceiling were imposed at point G, the loss in total economic surplus would be represented by the area ________.

A. DAC B. JAE + DGF C. GJEF D. FEC

Number of FigsVCMCAVCFCTCATC0???100??19090????2?????1353??80???4????400? Table 5.4 presents the cost schedule for David's Figs. If David produces zero figs, David's total costs are:

Table 5.4 presents the cost schedule for David's Figs. If David produces zero figs, David's total costs are:

A. $0. B. $90. C. $100. D. $130.