Which of the following accounts is credited by the seller when tax is collected on retail sales?

A) Accounts Payable

B) Payroll Tax

C) Sales Tax Payable

D) Unearned Revenue

C) Sales Tax Payable

You might also like to view...

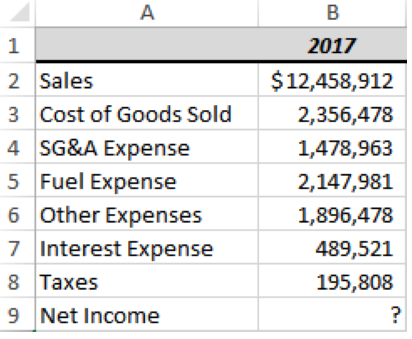

Which of the following is the correct formula for cell B9 to calculate the net income?

a) =B2-(B3-B4-B5-B6)-B7-B8

b) =B2+(B3-B4-B5-B6)-B7-B8

c) =B2-B3-B4-B5-B6-B7+B8

d) =B2-SUM(B2:B8)

e) =B2-SUM(B3:B8)

Truck wholesalers

A. don't own the products they sell. B. usually sell in large quantities-e.g., truckloads. C. don't stock the products they sell. D. usually sell perishable products that other wholesalers prefer not to carry. E. None of these answers is correct.

An insurance firm agrees to pay you $3,310 at the end of 20 years if you pay a premium of $100 per year at the end of each of the 20 years. Find the internal rate of return to the nearest whole percentage point.?

A. ?9% B. ?7% C. ?5% D. ?3% E. ?11%

Which of the following statements concerning pro forma disclosures is not true?

A. The SEC requires these to be presented only when the company has made an unusual asset exchange, or a restructuring of existing indebtedness. B. They show the effects of major transactions that occur after the end of the fiscal period. C. They often take the form of summarized financial statements. D. They show the effects of major transactions that have occurred during the year but are not fully reflected in the company's historical cost financial statements.