Explain how tax provisions to encourage private saving may reduce national saving

Without careful planning it is possible that a reduction in taxation of capital income (for example) would reduce government revenue. If there is no offsetting reduction in government spending the result is a budget deficit. This is a decrease in public saving. If the increase in private saving resulting from the tax change is not greater than the decrease in public saving the result is a decline in national saving.

You might also like to view...

Human capital is, in part, the

A) amount of money held by a worker. B) stock of knowledge of a worker. C) stock of plant and equipment. D) stock of financial assets held by the public.

The People's Bank of China has

A) allowed a flexible exchange rate to boost exports. B) managed its exchange rate to help control inflation. C) strictly followed a fixed exchange rate to boost exports. D) purchased U.S. dollars to appreciate the yuan.

Most goods whose purchases are included in the investment component of GDP are used to produce other goods in future periods

a. True b. False Indicate whether the statement is true or false

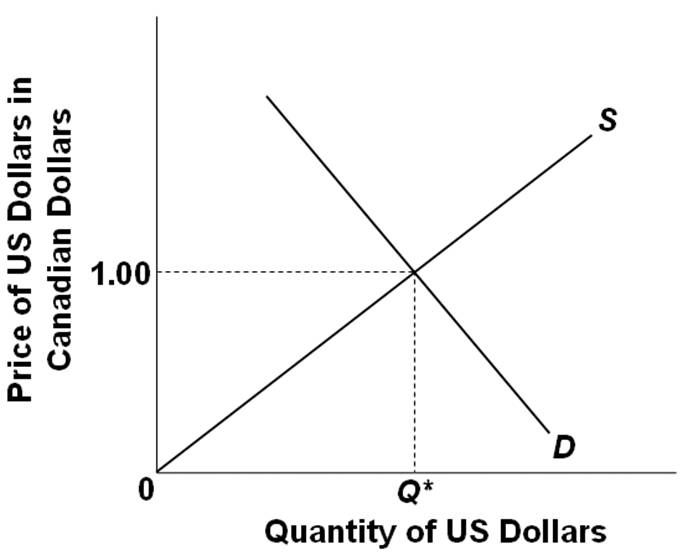

Refer to the graph above. If Canadian investors buy more U.S. financial and real assets, then:

A. The demand curve will shift left

B. The demand curve will shift right

C. The supply curve will shift left

D. The supply curve will shift right