Does a tax on buyers affect the demand curve?

A. Yes, it shifts down by the amount of the tax.

B. Yes, it shifts to the left by the amount of the tax.

C. Yes, it shifts up by the amount of the tax.

D. No, there is change in the quantity demanded, but the demand curve does not move.

A. Yes, it shifts down by the amount of the tax.

You might also like to view...

Which of the following is true about inflation?

a. It reduces the cost-of-living of the typical worker. b. It is measured by changes in the cost of a typical market basket of goods between time periods. c. It causes the purchasing power of a dollar to rise. d. It has no effect on real resources.

Which of the following would increase the incentive of consumers to economize and of producers to provide medical services at economical prices?

a. substitution of catastrophic health insurance plans for low deductible, low co-payment plans b. more reliance on medical savings accounts rather than insurance c. equalization of tax treatment between out-of-pocket medical expenses and employer-provided health insurance d. all of the above

What was very unusual about the 2001 recession, was that consumer spending ________________________.

Fill in the blank(s) with the appropriate word(s).

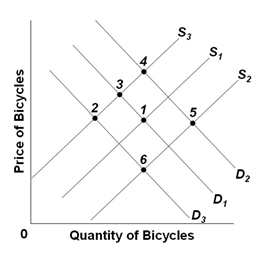

Refer to the graph below, which shows the market for bicycles. S1 and D1 are the original supply and demand curves. D2 and D3 and S2 and S3 are possible new demand and supply curves. Starting from the initial equilibrium (point 1), which point on the

graph is most likely to be the new equilibrium after an increase in wages of bicycle workers, and a significant increase in the price of gasoline?

A. 6

B. 3

C. 4

D. 5