In many economies, a substantial fraction of investment is by multinational corporations (MNCs) whose stock value is determined on global markets

Based on Tobin's q theory, how might we expect MNC investment to affect the volatility of aggregate investment in an economy?

If investment is sensitive to global market valuation, then it is less sensitive to economic conditions in a particular economy. The economy's business cycle should have lower amplitude, and investment should be less volatile. Unless the (global) market valuation of the MNCs is more volatile than the economy's aggregate investment, or happens to be closely correlated with the economy's business cycle.

You might also like to view...

Cash assets of a commercial bank consist of

A) notes and coins in the bank's vault, a deposit account at the Fed and loans to other banks. B) notes and coins in the bank's vault , a deposit account at the Fed and any gold held for the bank at Fort Knox. C) vault cash, a deposit account at the Fed and the bank's stock holdings. D) vault cash, a deposit account at the Fed and the value of its depositors' accounts.

According to the liquidity premium theory, what does a flat yield curve indicate?

A) Short-term interest rates are expected to remain stable. B) Short-term interest rates are expected to rise. C) Short-term interest rates are expected to fall. D) Long-term interest rates are expected to fall.

Compare changes in the price level for a recession resulting from a shift in aggregate demand to that of a recession resulting from a shift in short run aggregate supply

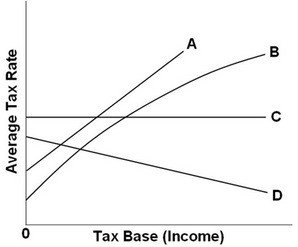

Refer to the above graph. Which of the lines in the above diagram represent(s) a progressive tax?

Refer to the above graph. Which of the lines in the above diagram represent(s) a progressive tax?

A. Both A and B B. B only C. C only D. D only