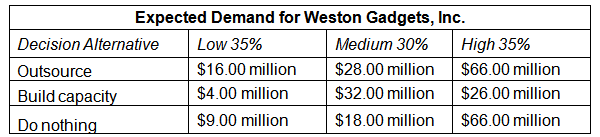

Refer to the data on Expected Demand for Weston Gadgets, Inc. For the various demand scenarios and their associated probabilities, the option to do nothing has an expected value of ______.

a. $37.10 million

b. $31.65 million

c. $20.10 million

d. $17.85 million

b. $31.65 million

You might also like to view...

The Freeman Corporation issues 2,000, 10-year, 8%, $1,000 bonds dated January 1 at 96 . The journal entry torecord the issuance will show a

a. debit to Cash of $2,000,000 b. credit to Discount on Bonds Payable for $80,000 c. credit to Bonds Payable for $1,920,000 d. debit to Cash for $1,920,000

Which strategy is often used to promote a stronger brand name?

A) affective B) cognitive C) conative D) generic

Useful information, including details about a company's financial history, industry data, and credit ratings is available from

A) the SEC. B) Standard & Poor's. C) The Wall Street Journal. D) a company's website.

Describe the sources of risk described in the chapter (liquidity, operating, financial, and worst-case scenarios).

What will be an ideal response?