Rick and Claudia live in an apartment and have purchased land where they plan to build their home. They have a mortgage on the lot and have received a Form 1098 from the lender showing the interest paid on the note. Interest paid on this loan is deductible as home mortgage interest on their Schedule A.

Answer the following statement true (T) or false (F)

False

To be deductible as home mortgage interest, the loan must be secured by a qualified residence.

You might also like to view...

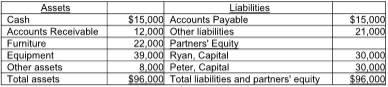

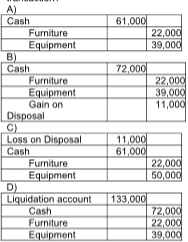

Ryan and Peter share profits in the ratio 3:2. They have decided to liquidate the partnership. They sold the furniture and equipment for $72,000. Which of the following is the correct journal entry for the sale transaction?

The balance sheet of Ryan and Peter's partnership as of December 31, 2018, is given below.

Which of the following statements about the various kinds of risks is correct?

A. Economic risk is a market risk, hence it should not be rewarded by the market. B. A firm's default risk is a diversifiable risk, hence it should be rewarded by the market. C. Exchange rate risk is a diversifiable risk, hence it should not be rewarded by the market. D. Inflation risk is an unsystematic risk, hence it should not be rewarded by the market. E. Interest rate risk is a systematic risk, hence it should be rewarded by the market.

Whereas the marketing channel is a group of interrelated organizations that directs products to customers, physical distribution deals with physical movement and storage of products both within and among intermediaries.

Answer the following statement true (T) or false (F)

The balance sheet summarizes the company's operations over the last fiscal year

Indicate whether the statement is true or false.