Which of the following is true of a partnership and a corporation?

A) In a corporation, income is taxed at the corporate level; whereas, in a partnership, income is taxed twice.

B) In a partnership, income is taxed once at the individual level; whereas, in a corporation, income is taxed twice.

C) Income from both forms of organizations are double-taxed.

D) In a partnership, income is exempted from tax up to $10 million; whereas, in a corporation, income is taxed twice.

B) In a partnership, income is taxed once at the individual level; whereas, in a corporation, income is taxed twice.

You might also like to view...

You asked your employee, Sarah, to conduct an evaluation of the m-learning method that was implemented to support field engineers’ work. Sarah wrote this purpose statement: ? The purpose of this evaluation is to investigate positive and negative outcomes of the m-learning strategy used among field engineers. Is Sarah planning to conduct a goal-based evaluation or a goal-free evaluation?

a. goal-based evaluation b. goal-free evaluation

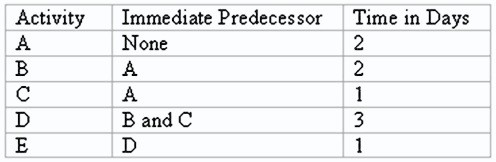

A simple project listing of five activities, their predecessors, and their respective time estimates are presented here:  Using the CPM, which activities have slack in this project?

Using the CPM, which activities have slack in this project?

A. A B. B C. C D. D E. C and E

Which method of analyzing the cost of life insurance does not consider the cash value of the policy in the analysis?

A) traditional net cost method B) net payment cost index C) the Linton Yield D) the surrender cost index

A judgment can be recorded generally against all the debtor's property

Indicate whether the statement is true or false