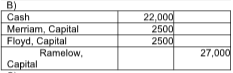

They agreed to admit Ramelow into the business for a one-third interest in the new partnership. Ramelow contributes $22,000 cash in exchange for the partnership interest. Assume that Floyd and Merriam shared profits and losses equally before the admission of Ramelow. Which of the following is the correct journal entry to record the above admission?

Floyd and Merriam start a partnership business on June 12, 2019. Their capital account balances as of December 31, 2020 stood as follows:

![]()

Explanation: Existing capital $59,000

Contribution of new partner 22,000

Capital after admission 81,000

Capital of new partner ($81,000 × 1 / 3) 27,000

Bonus to new partner ($27,000 - $22,000) $5000*

*(to be borne equally by Floyd and Merriam)

A new partner may be so valuable that the existing partners offer a partnership share that includes a

bonus to the new partner. The bonus of $5000 went to Ramelow from the other partners, so their capital

accounts are debited for the bonus. The existing partners (Floyd and Merriam) share this decrease in

capital as though it were a loss, on the basis of their profit-and-loss sharing ratio.

You might also like to view...

Lui Company's 2010 income statement reported total sales revenue of $350,000 . The 2009-2010 comparative balance sheets showed that accounts receivable increased by $20,000 . The 2010 "cash receipts from customers" would be

a. $270,000 b. $250,000 c. $330,000 d. $40,000

Organizations’ external environments are ______.

A. continuous B. discontinuous C. stable D. both A and C

U.S. district courts have original jurisdiction in federal matters

a. True b. False Indicate whether the statement is true or false

Within the context of systems theory, describe the relationship between the organization and society.

What will be an ideal response?