Jamal earns $160,000 per year and Josephina earns $80,000 per year. If Jamal pays $16,000 in income taxes and Josephina pays $8,000 in income taxes, the income tax system would be

A) regressive.

B) progressive.

C) proportional.

D) marginal.

Answer: C

You might also like to view...

When crowding out occurs in an economy, it can reduce expenditures for

A. business investments. B. both consumer purchases and business investments. C. consumer purchases. D. government purchases.

Compared to countries with less economic freedom, countries with more economic freedom

a. achieve higher per person income levels, but they also have higher poverty rates. b. grow more rapidly, but the income levels of the poor are largely unaffected by the higher growth rates of the freer economies. c. achieve both higher income levels per person and lower rates of poverty. d. grow less rapidly and experience higher poverty rates.

Assume that the supply of coffee in a competitive market decreases. What will most likely happen to the equilibrium price and quantity of coffee?

a. Price will increase; quantity will increase b. Price will decrease; quantity will increase c. Price will increase; quantity will decrease d. Price will decrease; quantity will decrease

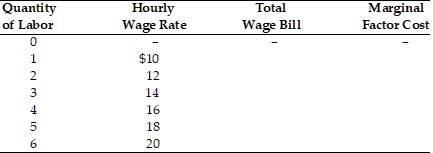

In the above table, if the marginal revenue product is $18, how many workers will the profit maximizing monopsonist hire and what wage will they pay each worker?

In the above table, if the marginal revenue product is $18, how many workers will the profit maximizing monopsonist hire and what wage will they pay each worker?

A. 3; $18 B. 5; $18 C. 4; $16 D. 3; $14