When firms use symbols, colors, or characters to convey their personalities, they are using ________ differentiation

A) image

B) people

C) usage-rate

D) user-status

E) channel

A

You might also like to view...

A substantive strategy differs from a reliance strategy in that a substantive strategy includes:

A. extra tests of controls. B. increased emphasis on verbal representations from management. C. increased implementation of detailed tests of transactions and balances. D. setting control risk at a minimum level.

If an agent reveals confidential information of a principal to a third party, one of principal's courses of action may be to obtain an injunction against the third party

Indicate whether the statement is true or false

The finance function is concerned with:

A) producing goods or providing services. B) procuring materials, supplies, and equipment. C) building and maintaining a positive image. D) generating the demand for the organization's products or services. E) securing monetary resources.

Prepare a Calculation of Non-Controlling Interest as at December 31, 2018 for Plax Inc.

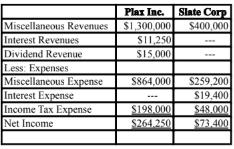

The financial statements of Plax Inc. and Slate Corp for the year ended December 31, 2018 are shown below:

Income Statements

Retained Earnings Statements

Balance Sheets

Other Information:

> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the

straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

What will be an ideal response?