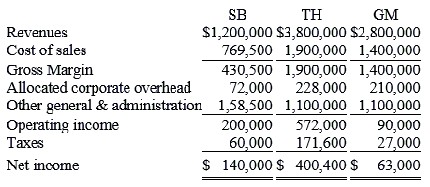

Seaside Enterprises has the following data for its three divisions for the year: SB TH GM Revenues$1,200,000 $3,800,000 $2,800,000 Cost of sales 769,500 1,900,000 1,400,000 Allocated corporate overhead 72,000 228,000 210,000 Other general & administration 158,500 1,100,000 1,100,000 Required:a. Compute divisional operating income for each of the divisions. Assume taxes are 30%.b. Calculate the gross margin ratio for each division.c. Calculate the operating margin ratio for each division.d. Calculate the profit margin ratio for each division.

What will be an ideal response?

a.

b. SB: $430,500/$1,200,000 = 35.88%; TH: $1,900,000/$3,800,000 = 50%; GM: $1,400,000/$2,800,000 = 50%

c. SB: $200,000/$1,200,000 = 16.67%; TH: $572,000/$3,800,000 = 15.05%; GM: $90,000/$2,800,000 = 3.21%

d. SB: $140,000/$1,200,000 = 11.67%; TH: $400,400/$3,800,000 = 10.54%; GM: $63,000/$2,800,000 = 2.25%

You might also like to view...

Park, Inc purchased merchandise from Jay Zee Music Company on June 5, 2016 . The goods were shipped the same day. The merchandise's selling price was $15,000 . The credit terms were 1/10, n/30 . The shipping terms were FOB shipping point. Park received the merchandise on June 10, 2016 . Park paid the amount due on June 13, 2016. When did title to the merchandise transfer from Jay Zee Music

Company to Park? a. June 10, 2016 b. June 5, 2016 c. June 13, 2016 d. Cannot be determined from the information provided

Which of the following is true regarding the general journal?

A) It keeps up to date records of all customers and suppliers. B) It helps divide up accounting tasks. C) It helps prevent errors. D) It helps control the spending of the organization.

If there is no legal way to keep competitors out of the market, these costs must be viewed as sunk costs that do not affect decision making after the product is introduced into the market. Identify the type of cost being discussed

A) development cost B) variable cost C) direct fixed cost D) overhead cost

The supervisor is the best person to determine the existence of a "phantom employee" and should distribute paychecks

Indicate whether the statement is true or false