In the press, there has been a considerable amount of attention given to the notion of corporations being taxed. Explain how it is that a tax on a business could be borne entirely by consumers.

What will be an ideal response?

Elasticity plays a key role in determining exactly how much tax is borne by consumers and

producers.

You might also like to view...

The choice of a voter to remain uninformed because the marginal cost of obtaining information is greater than the marginal benefit from obtaining knowledge is called:

a. irrational ignorance. b. rational ignorance. c. collective interest. d. choice.

The deleveraging of financial institutions led to the financial crisis of 2007-2008 sometimes also referred to as the _____

a. stock crisis b. debt crisis c. stock market bubble d. bank run e. credit crisis

At a short-run equilibrium ________, while at a long-run equilibrium ________.

A. there is an output gap; output equals potential output B. the inflation rate is stable; there is an output gap C. output equals potential output; the inflation rate is stable D. output is at a level consistent with inflation; there is an output gap

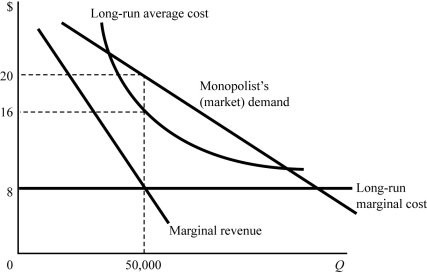

Consider an unregulated monopoly in Figure 8.13. If that monopoly sets its price equal to its marginal cost, it would:

Consider an unregulated monopoly in Figure 8.13. If that monopoly sets its price equal to its marginal cost, it would:

A. earn negative profits. B. earn maximum profits. C. earn zero profits. D. earn small, but greater than zero, profits.