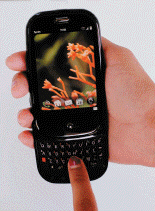

The cell phone in the accompanying photo is a(n) ____ phone.

The cell phone in the accompanying photo is a(n) ____ phone.

A. intelligent

B. smart

C. contemporary

D. cable

Answer: B

You might also like to view...

From 1970 to 2000, the U.S. dollar

A. appreciated against the U.K. pound and depreciated against the Canadian dollar. B. depreciated against the U.K. pound and appreciated against the Canadian dollar. C. appreciated against both the U.K. pound and the Canadian dollar. D. depreciated against both the U.K. pound and the Canadian dollar.

To be useful, market segments must be measurable

Indicate whether the statement is true or false

The most recent comparative balance sheet of Giacomelli Corporation appears below:Comparative Balance Sheet Ending BalanceBeginning BalanceAssets: Current assets: Cash and cash equivalents$37,000 $29,000 Accounts receivable 20,000 24,000 Inventory 65,000 61,000 Prepaid expenses 5,000 7,000 Total current assets 127,000 121,000 Property, plant, and equipment 424,000 399,000 Less accumulated depreciation 231,000 200,000 Net property, plant, and equipment 193,000 199,000 Total assets$ 320,000 $ 320,000 Liabilities and stockholders' equity: Current liabilities: Accounts payable$19,000 $17,000 Accrued liabilities 58,000 51,000 Income taxes payable 47,000 42,000 Total

current liabilities 124,000 110,000 Bonds payable 77,000 80,000 Total liabilities 201,000 190,000 Stockholders' equity: Common stock 31,000 30,000 Retained earnings 88,000 100,000 Total stockholders' equity 119,000 130,000 Total liabilities and stockholders' equity$ 320,000 $ 320,000 The company uses the indirect method to construct the operating activities section of its statement of cash flows.Which of the following is correct regarding the operating activities section of the statement of cash flows? A. The change in Prepaid Expenses will be subtracted from net income; The change in Income Taxes Payable will be added to net income B. The change in Prepaid Expenses will be subtracted from net income; The change in Income Taxes Payable will be subtracted from net income C. The change in Prepaid Expenses will be added to net income; The change in Income Taxes Payable will be subtracted from net income D. The change in Prepaid Expenses will be added to net income; The change in Income Taxes Payable will be added to net income

The memorized sales presentation is referred to as persuasive selling presentation.

Answer the following statement true (T) or false (F)