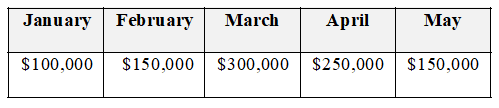

Active Life Inc., a sports equipment retailer, needs to prepare a cash budget for the first quarter of 2018. The financial staff at Active Life has forecasted the following sales figures:

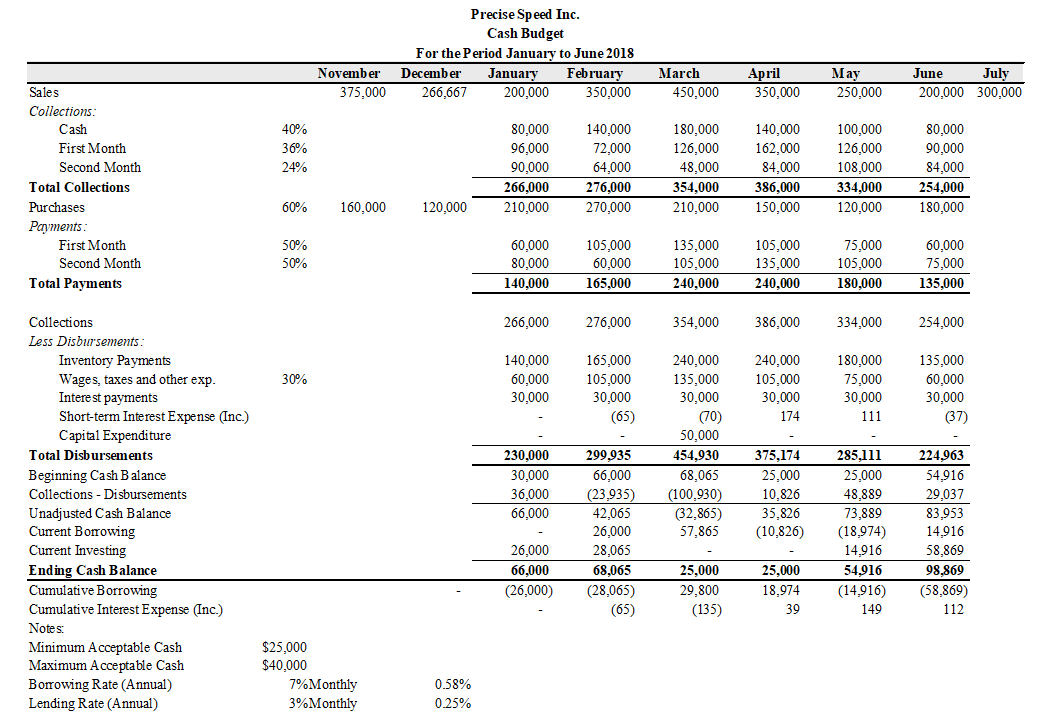

Actual sales in October, November, and December 2017 were $125,000, $146,000, and $125,000, respectively. Cash sales are 40% of the total, and the rest are on credit. Under the current credit policy the firm expects to collect 60% of credit sales the following month, 30% two months after, and the remainder in the third month after the sale.

Each month, the firm makes inventory purchases equal to 45% of the of the next month’s sales. The firm pays for 40% of its inventory purchases in the same month and 60% in the following month; nevertheless, the firm enjoys a 2% discount if it pays during the same month as the purchase.

Estimated disbursements include monthly wages and other expenses representing 25% of the same month’s sales; a major capital outlay of $30,000 expected in January; a dividend payment of $25,000 in February; $40,000 of long-term debt maturing in March; and a tax payment of $60,000 in April. The interest rate on its short-term borrowing is 7%. It has a required minimum cash balance of $10,000 every month, and has an ending cash balance of $30,000 for December 2017.

Using the above information, create a cash budget for January to June 2018. The cash budget should account for short-term borrowing and payback of outstanding loans.

Using Excel’s outline feature, group the worksheet area at the top of the cash budget so that the preliminary calculations can be easily hidden or unhidden.

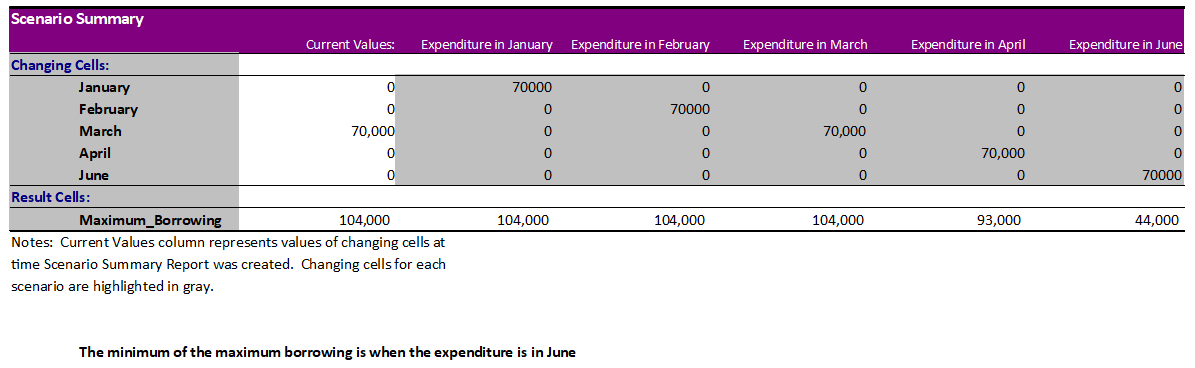

Ms. Elaine Benes, Active Life’s CFO, is considering three credit proposals from the firm’s supplier. In the first proposal the firm will pay 75% of its purchases in the same month and 25% in the following month; in the second proposal the firm will pay half in the same month and half in the following month; in the third proposal the firm will pay 25% of its purchases in the same month and 75% in the following month. Suppliers have offered 4%, 3%, and 2% discounts over the payments made during the same month of the purchase if the firm pays according to the first, second, and third proposals, respectively. The CFO has asked you to use the Scenario Manager to see which proposal has the lowest total interest cost.

Ms. Benes is now considering three credit policies from the firm’s customers. In the first policy the firm will sell 60% on cash and will collect 60% of the balance during the first month, and the remaining balance during the second month. In the second policy, 50% of sales will be on cash, and the firm will collect 50%, 30%, and 20% of credit sales during the first, second, and third months, respectively. The last policy consists of 40% sales on cash, and 40%, 30%, and 30% of the remaining balance will be collected during the first, second, and third months, respectively. The CFO has asked you to use the Scenario Manager to see what credit proposal has the lowest total interest cost.

You might also like to view...

The new drug proved to be highly effective, it has no side effects

A) properly constructed sentence B) comma splice C) lacks parallel parts D) dangler E) has unclear pronoun

In Latin American Music v. Media Power Group, where radio station owner Media was sued by Latin for copyright infringement for playing music without a license, the appeals court held that:

a. Media's infringements were "innocent" so it did not have to pay any damages b. Media's infringements were "innocent" so it had to pay only $200 per download c. Media's infringements were "knowing" so it would pay $750 per download d. Media did not infringe because Latin could not provide proof of copyright ownership e. none of the other choices are correct

Which of the following is a common risk avoidance and mitigation strategies?

A) assigning the best human resources available to reduce a specific type of project risk B) choosing an alternative technical approach to avoid risk exposure C) subcontracting a specific deliverable to a third-party D) all of the above

Which of the following is a valid reason for making a 754 election?

A) An incoming partner pays more for a partnership interest that his or her proportionate share of partnership assets. B) Partners are able to increase their basis in the partnership interest upon the sale of a partnership interest. C) Partnerships can increase, but not decrease, their basis in partnership assets. D) A partnership can reduce its basis in assets upon cash distributions to partners.