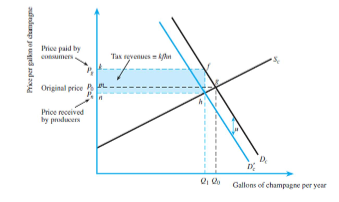

Refer to the figure below. Suppose the original before-tax demand curve for CD players is P = 100 - 2Q d . Suppose further that supply is P = 5 + 3Q s . Now suppose a $5 unit tax is imposed on consumers.

(A) What is the before-tax equilibrium price and quantity?

(B) What is the after-tax equilibrium price and quantity?

(C) How much tax revenue is raised?

(A) Setting before-tax demand equal to supply gives Q* = 19, with P* = $62.

(B) The after-tax demand curve is now P = 95 - 2Q d . Setting the after-tax demand curve equal

to supply gives Q* = 18, and P* = 59.

(C) Tax revenue is the after-tax equilibrium quantity multiplied by the tax rate. Therefore, $5 ×

(18) = $90.

You might also like to view...

The question "Will doctors or lawyers have higher annual incomes?" represents which of the three basic economic questions?

What will be an ideal response?

The General Agreement on Tariffs and Trade is an international agreement

A) that outlaws all tariffs but permits quotas. B) to encourage world trade by lowering tariffs and other trade barriers. C) to encourage world trade by lending resources to developing countries. D) between the United States and Japan that has never been ratified, resulting in several trade wars with Japan.

Individuals with higher saving and investment rates will more likely

What will be an ideal response?

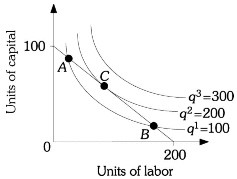

Refer to the information provided in Figure 7.10 below to answer the question(s) that follow.  Figure 7.10Refer to Figure 7.10. The firm's level of total cost is represented by the given isocost line. At the optimal combination of capital and labor, the firm produces ________ units of output.

Figure 7.10Refer to Figure 7.10. The firm's level of total cost is represented by the given isocost line. At the optimal combination of capital and labor, the firm produces ________ units of output.

A. 100. B. 200. C. 300. D. indeterminate from this information.