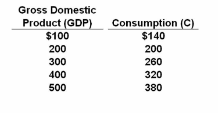

Refer to the data. The 10 percent proportional tax on income would cause:

Answer the question on the basis of the following before-tax consumption

schedule for an economy:

A. both consumption and saving to increase by larger and larger absolute amounts as GDP

rises.

B. both consumption and saving to increase by smaller and smaller absolute amounts as GDP rises.

C. consumption to decrease by larger amounts and saving to decrease by smaller amounts

as GDP rises.

D. no change in the amounts consumed and saved at each level of GDP.

B. both consumption and saving to increase by smaller and smaller absolute amounts as GDP rises

You might also like to view...

The marginal propensity to consume (MPC) is the change in consumption divided by the change in saving

a. True b. False Indicate whether the statement is true or false

The problem with using a basic needs measure of poverty is that

a. the median income changes b. what we think of as basic needs now differs from what basic needs were 20 years ago c. we don't know how to measure basic needs d. basic needs is a relative concept of poverty e. population changes

Total fixed cost for a firm is €25. The variable cost to the firm to produce 1 unit is €10. The marginal cost of producing the first unit is:

(a) €10. (b) €15. (c) €25. (d) €35.

As coffee becomes more expensive, Joe starts drinking tea, and therefore quantity demanded for coffee decreases. This is called:

A. the income effect. B. the change in equilibrium. C. the substitution effect. D. a shift in the demand curve