In the formula for a straight line, the b stands for the ________

A) intercept

B) dependent variable

C) independent variable

D) slope

E) predicted variable

D

You might also like to view...

The audit report is modified to five paragraphs as a result of another audit firm performing part of the financial statement audit

a. True b. False Indicate whether the statement is true or false

In social customer relationship management, relationships between organizations and customers are fixed

Indicate whether the statement is true or false

Choose the incorrect choice regarding the descriptions of the primary functions of inventories. (1). Pipeline inventory: inventories traveling from one location to another (2). Seasonal inventories: inventories accumulated during low sales periods and depleted during high usage periods (3). Safety stocks: inventories used to absorb random demand uncertainties

a. (1) c. (2) and (3) b. (2) d. None of the above

Prepare Remburn's statement of consolidated retained earnings as at December 31, 2015.

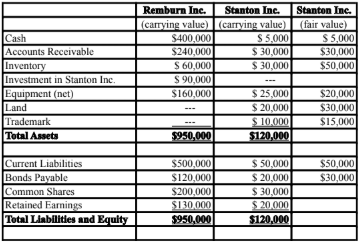

Remburn Inc. Inc. purchased 90% of the outstanding voting shares of Stanton Inc. for $90,000 on January 1, 2015. On that date, Stanton Inc. had common shares and retained earnings worth $30,000 and $20,000, respectively. The equipment had a remaining useful life of 10 years from the date of acquisition. Stanton's trademark is estimated to have a remaining life of 5 years from the date of acquisition. Stanton's bonds mature on January 1, 2035. The inventory was sold in the year following the acquisition. Both companies use straight line amortization, and no salvage value is assumed for assets. Remburn Inc. and Stanton Inc. declared and paid $12,000 and $4,000 in dividends, respectively during the year.

The balance sheets of both companies, as well as Stanton's fair values on the date of acquisition are shown below:

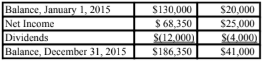

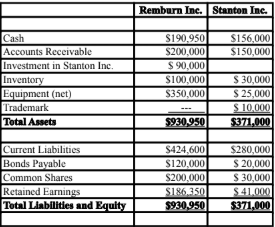

The following are the financial statements for both companies for the fiscal year ended December 31, 2015:

Income Statements

Retained Earnings Statements

Balance Sheets

Both companies use a FIFO system, and Stanton's entire inventory on the date of acquisition was sold during the following year. During 2015, Stanton Inc. borrowed $20,000 in cash from Remburn Inc. interest free to finance its operations. Remburn uses the Cost Method to account for its investment in Stanton Inc. Moreover,

Stanton sold all of its land during the year for $18,000. Goodwill impairment for 2015 was determined to be $7,000. Remburn has chosen to value the non-controlling interest in Stanton on the acquisition date at the fair value of the subsidiary's identifiable net assets (parent company extension method).