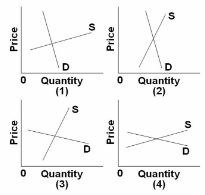

In which of the given market situations will the largest portion of an excise tax of a specified amount per unit of output be borne by producers?

A. 4.

B. 3.

C. 1.

D. 2.

B. 3.

You might also like to view...

If the real interest rate falls, people decide to ________ because the opportunity cost of ________

A) decrease their consumption expenditure; consumption has decreased B) increase their consumption expenditure; consumption has decreased C) increase their consumption expenditure; saving has decreased D) save more; saving has decreased E) None of the above answers is correct.

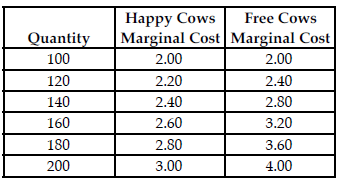

Refer to the table below. Suppose the perfectly competitive market for dairy products had a 40 percent chance of a high price of $3.00 and a 60 percent chance of a low price of $2.00. However, both Happy Cows and Free Cows have revised their probabilities and now believe that the probability of a high price of $3.00 is 80 percent and the probability of a low price of $2.00 is 20 percent. If the

managers of Happy Cows want to maximize expected profit based on the new probabilities by how much will they change the quantity produced?

Happy Cows and Free Cows are two separate perfectly competitive dairy farms. The table above shows the respective firms' marginal cost at various production levels.

A) Happy Cows will decrease their production by 20 units.

B) Happy Cows will decrease their production by 40 units.

C) Happy Cows will increase their production by 40 units.

D) Happy Cows will increase their production by 20 units.

The World Bank sorts countries into the following three major groups:

a. high-income economies, middle-income economies, low-spending economies b. high-spending economies, middle-spending economies, low-spending economies c. super-high-income economies, middle-income economies, low-income economies d. high-income economies, middle-income economies, zero-income economies e. high-income economies, middle-income economies, low-income economies

Which of the following statements is correct?

a. A minimum wage law will result in less additional unemployment if labor demand is elastic rather than inelastic. b. An in-kind transfer allows a person to use the benefit to purchase whatever they think they need most. c. If a tax policy states that taxes owed equal 1/3 of income less $15,000 . a person earning $25,000 per year would owe $6,666.67 in taxes. d. Welfare reform enacted in 1996 limited the amount of time recipients could stay on welfare.