When the Fed acts as a "lender of last resort", like it did in the financial crisis of 2007-2008, it is performing its role of:

A. Controlling the money supply

B. Setting the reserve requirements

C. Being the bankers' bank

D. Providing for check clearing and collection

C. Being the bankers' bank

You might also like to view...

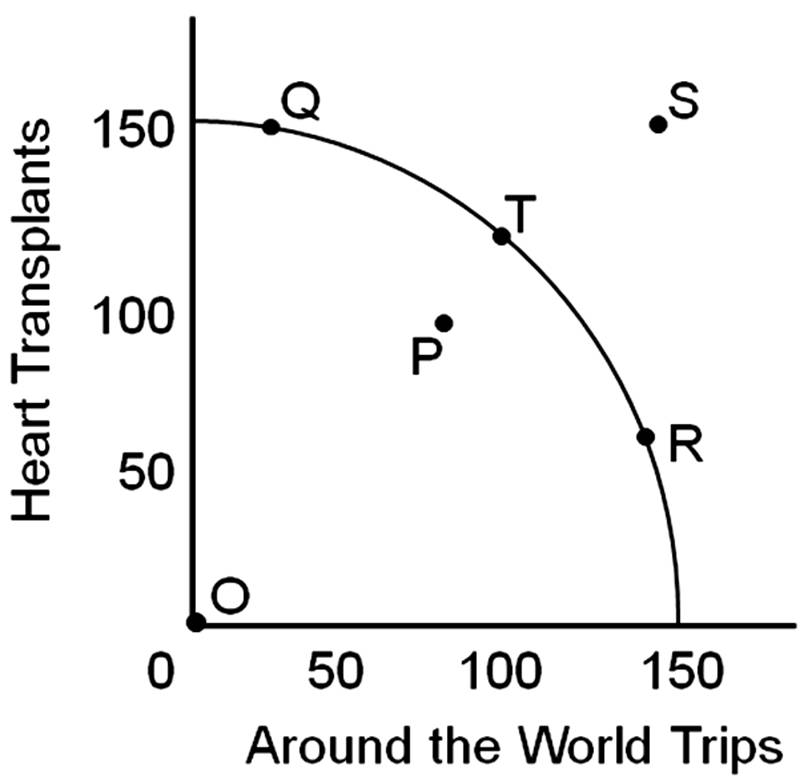

If we are currently at point T, we can get to point S in the long run

A. through economic growth over a period of years.

B. immediately by using resources more efficiently.

C. immediately by reducing the unemployment rate.

D. immediately through technological development.

Suppose a competitive firm is paying a wage of $12 an hour and sells its product at $3 per unit. Assume that labor is the only input. If hiring another worker would increase output by three units per hour, then to maximize profits the firm should

A) not hire an additional worker. B) not change the number of workers it currently hires. C) hire another worker. D) There is not enough information to answer the question.

What is the interest rate that should be used to ensure a total balance of $3,000 two years from now if you have a starting balance of $2,000?

What will be an ideal response?

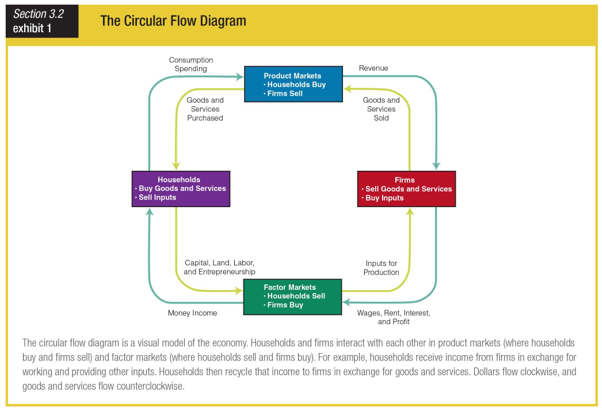

In the circular flow diagram, consumer products flow ______.

a. the same way as dollars

b. clockwise

c. counter clockwise

d. from the innermost circle