Riskier investments tend to sell for:

A. lower prices so they provide a higher expected rate of return to compensate for risk.

B. higher prices so they provide a higher expected rate of return to compensate for risk.

C. higher prices; that is why they are considered to be riskier.

D. prices directly correlated with expected rates of return.

A. lower prices so they provide a higher expected rate of return to compensate for risk

You might also like to view...

Suppose that a regulatory agency helps producers maximize economic profit. This type of regulation coincides with

A) a natural monopoly. B) a marginal cost pricing rule. C) an average cost pricing rule. D) the capture theory of regulation. E) the social interest theory of regulation.

A firm has to choose between projects X and Y. Project X's internal rate of return is positive. If the cash flow of project Y is discounted at project X's internal rate of return, this firm will

A) choose project X if the net present value of project Y is positive. B) choose project X if the net present value of project Y is negative. C) choose project Y if the net present value of project Y is positive. D) choose project X regardless of the net present value of project Y.

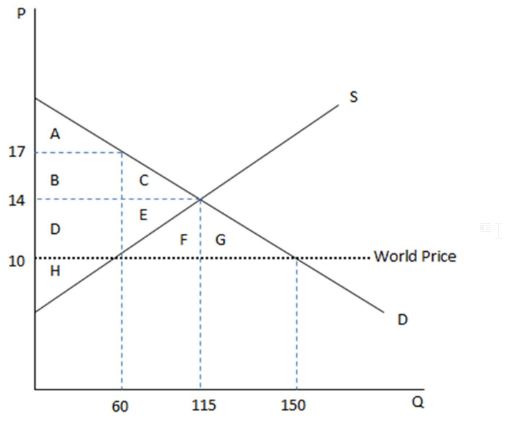

According the graph shown, if this economy were open to free trade, it would:

This graph demonstrates the domestic demand and supply for a good, as well as the world price for that good.

A. import this good, because the domestic price is greater than the world price.

B. export this good, because the domestic price is greater than the world price.

C. import this good, because the world price is greater than the domestic price.

D. export this good, because the world price is greater than the domestic price.

If an economy consumes 75 percent of any increase in real GDP and spends 10 percent of this increased income on imports, then a decline in government spending by $60 million will result in a total reduction in equilibrium income of:

a. $171.43 million. b. $123.47 million. c. $151.63 million. d. $73.47 million. e. $71.43 million.