A bond has a current market value of $800. The holder of the bond will receive a single payment of $1,000 one year from now. The interest rate is 10 percent. The effective yield on the bond is:

A) $200.

B) 10 percent.

C) 25 percent.

D) negative.

E) The yield cannot be determined with the information provided.

C

You might also like to view...

The reduction of brokerage commissions for trading common stocks that occurred in 1975 caused the demand for bonds to ________ and the demand curve to shift to the ________

A) fall; right B) fall, left C) rise; right D) rise; left

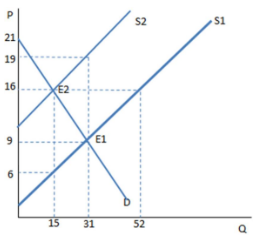

The graph shown demonstrates a tax on sellers. What is the amount of tax revenue being generated from the tax?

A. $150

B. $80

C. $310

D. $135

The absolute value of the slope of an indifference curve is called the:

a. marginal rate of transformation. b. transitivity slope. c. indifference rate of preference. d. marginal rate of substitution.

Explain how the existence of discouraged workers alters the extent to which the official unemployment provides an accurate measure of the use of labor resources

What will be an ideal response?