According to Ricardian Equivalence, a tax cut will not have a material impact on consumption spending since ________

A) households will simply save the monies received from the tax cut

B) the value of the tax multiplier is one

C) a tax cut must lead to an increase in prices, which leaves the real value of consumption unchanged

D) a decrease in taxes will be balanced, under current federal law, by a government spending increase

A

You might also like to view...

If the prices would have been much higher ten years ago for the items the average consumer purchased last month, then one can likely conclude that

A) the aggregate price level has declined during this ten-year period. B) the average inflation rate for this ten-year period has been positive. C) the average rate of money growth for this ten-year period has been positive. D) the aggregate price level has risen during this ten-year period.

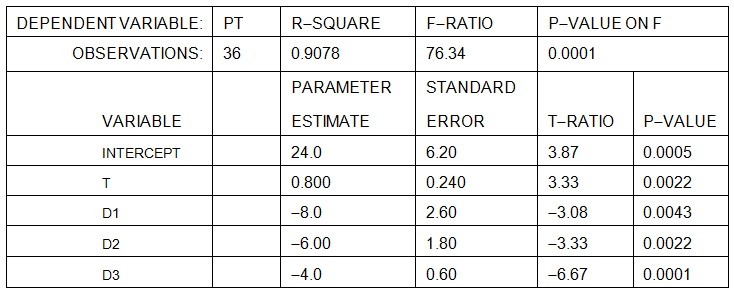

The manufacturer of Beanie Baby dolls used quarterly price data for 2005 I - 2013 IV (t = 1, ..., 36) and the regression equationPt = a + bt + c1D1t + c2D2t + c3D3tto forecast doll prices in the year 2014. Pt is the quarterly price of dolls, and D1t, D2t, and D3t are dummy variables for quarters I, II, and III, respectively.  In any given year price tends to vary from quarter to quarter as follows:

In any given year price tends to vary from quarter to quarter as follows:

A. PI > PII > PIII > PIV B. PII > PIII > PIV > PI C. PIII > PI > PII > PIV D. PI > PIV > PIII > PII E. PIV > PIII > PII > PI

To grow and prosper, less-developed countries must not:

A. invest in human capital. B. build a strong infrastructure. C. shift resources out of the production of consumer goods and into the production of capital goods. D. shift resources out of the production of capital goods and into the production of consumer goods

Active policymaking refers to

A. relying on policies that act as automatic stabilizers. B. policy making that is carried out in response to a rule. C. nondiscretionary policymaking. D. actions taken by policy makers in response to a change in the overall economy.