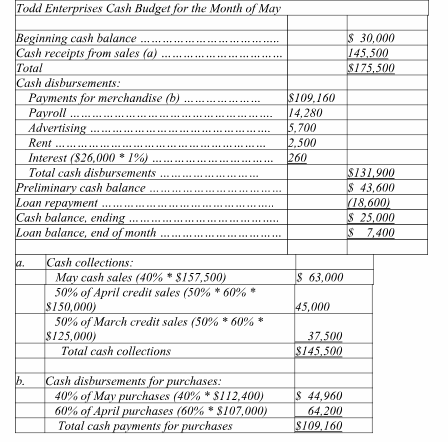

Prepare the company's cash budget for May. Show the ending loan balance at May 31.

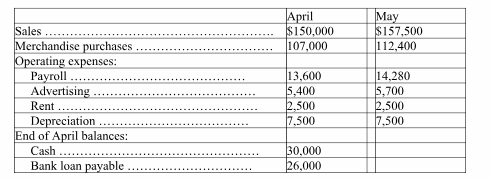

Todd Enterprises is preparing a cash budget for the second quarter of the coming year. The following data have been forecasted:

Additional data:

(1) Sales are 40% cash and 60% credit. The collection pattern for credit sales is 50% in the month following the sale and 50% in the month thereafter. Total sales in March were $125,000.

(2) Purchases are all on credit, with 40% paid in the month of purchase and the balance paid in the following month.

(3) Operating expenses are paid in the month they are incurred.

(4) A minimum cash balance of $25,000 is required at the end of each month.

(5) Loans are used to maintain the minimum cash balance. At the end of each month, interest of 1% per month is paid on the outstanding loan balance as of the beginning of the month. Repayments are made whenever excess cash is available.

Prepare the company's cash budget for May. Show the ending loan balance at May 31.

You might also like to view...

Which of the following is an accurate description of the null hypothesis?

A) a formal statement that there is a significant difference between the hypothesized value and the value we find in our sample B) a formal statement that there is no difference between the hypothesized value and the value we find in our sample C) a formal statement that there is a slight difference between the hypothesized value and the value we find in our sample D) an informal statement that there is a large difference between the hypothesized value and the value we find in our sample E) an informal statement that there is an average difference between the hypothesized value and the value we find in our sample

Why might SFAC No. 5 be considered a “failure”?

What will be an ideal response?

Liquidated damages can be claimed in addition to actual damages

Indicate whether the statement is true or false

On January 1, Jewel Company buys $200,000 of Marcelo Corp. 12%, 36-month notes. Interest is paid on the last day of each month. The notes are classified as available-for-sale securities. This is the company's first and only investment in available-for-sale securities. On December 31, the notes have a fair value of $204,000. The journal entry to record the receipt of the monthly interest on January 31 is:

A. Debit Cash $2,000; credit Interest Revenue $2,000. B. Debit Cash $2,000; credit Debt Investments-AFS $2,000. C. Debit Cash $2,000; credit Fair Value Adjustment-AFS (LT) $2,000. D. Debit Cash $2,000; credit Fair Value Adjustment-AFS (ST) $2,000. E. Debit Cash $24,000; credit Debt Investments-AFS $24,000.