Suppose an oil cartel has an agreement to restrict members' production in order to maintain a price of $30 per barrel. A single cartel member may want to cheat and exceed its quota so that it can:

A. reduce its costs.

B. charge higher prices.

C. make demand more inelastic.

D. earn a bigger profit.

Answer: D

You might also like to view...

Momentum investing can be described as

A) consistent with the efficient markets hypothesis. B) similar to mean reversion. C) follow the picks of investors who have been successful in the past. D) the trend is your friend.

Sail Away is competing in the sailboat market with Best Sails. Sail Away drops its price below its cost and, in doing so, drives Best Sails out of the market. Once Sail Away is a monopoly, they raise their price and enjoy economic profit. This is an example of ________.

A) market division B) output restrictions C) resale price maintenance D) predatory pricing

Which of the following is most likely to reduce a federal budget surplus?

A. Lower inflation and lower unemployment rates. B. A booming economy with rising inflation rates. C. A recession. D. Higher inflation and higher unemployment rates.

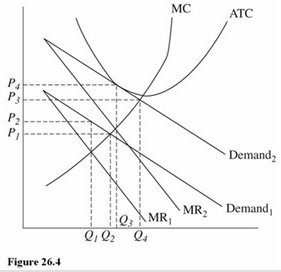

Refer to Figure 26.4 for a monopolistically competitive firm. In the long run this firm is most likely to face

Refer to Figure 26.4 for a monopolistically competitive firm. In the long run this firm is most likely to face

A. A demand curve between Demand1 and Demand 2. B. Demand2 and MR2. C. Demand1 and MR2. D. Demand1 and MR1.